Top Pharma & Biotech Deals, Investments, M&As in September 2018

As compared to the previous months, September was a slower month for dealmaking. The Wall Street Journal recently attributed the drought in big biotech deals to the riskiness of the business. In a note to clients, a Jefferies health care trader wrote: “What appears to be a best-in-class drug on a Monday can often be deemed obsolete headed into the weekend, given the pace of development”.

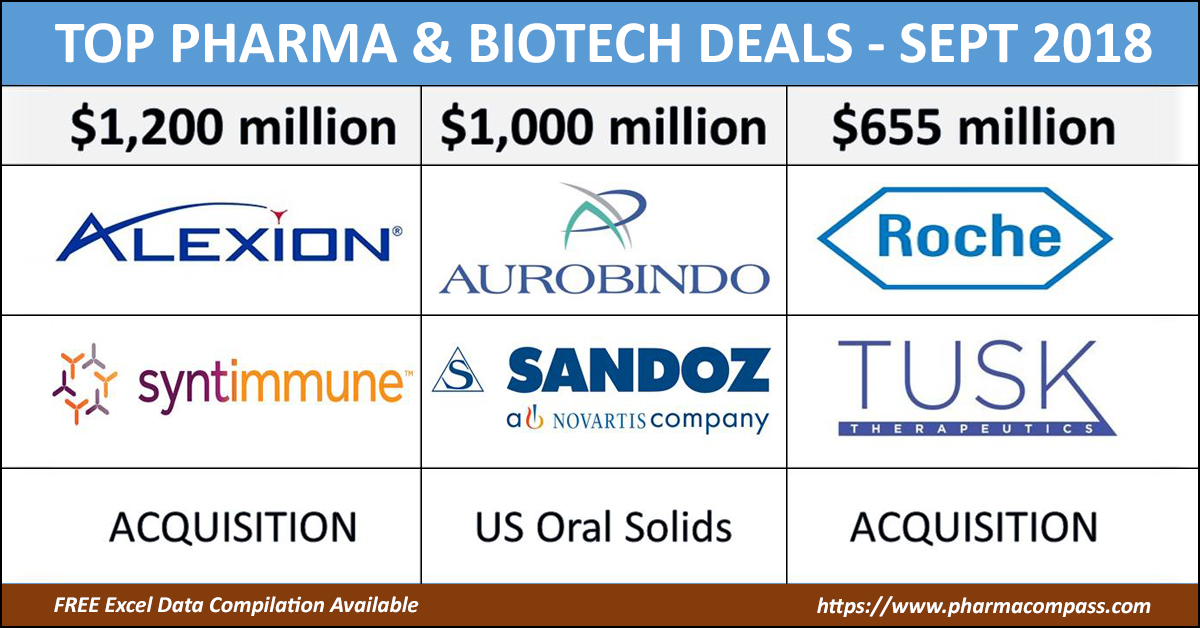

Last month, Novartis continued its strategic revamp by selling selected portions of its Sandoz US generics portfolio and Alexion diversified its rare disease pipeline. In addition, a lot of companies announced large investments into manufacturing.

Novartis unloads troubled US generics to India’s Aurobindo Pharma

Novartis finally got rid of some troubled US generic assets when it sold 300 products and several development projects in its Sandoz US generic oral solids and dermatology business to Indian drug maker Aurobindo Pharma for US$ 1 billion. Aurobindo agreed to pay US$ 900 million upfront and up to US$ 100 million in performance payments.

The deal relieves Novartis of a troubled franchise, while catapulting Aurobindo to the position of the second-largest generics player by prescriptions in the US.

The deal with Aurobindo is part of Novartis’ effort to focus Sandoz’s US operations on higher-margin assets like biosimilars and complex generics, which would include injectables, respiratory drugs and eye therapies.

As part of the deal, Aurobindo also gets Sandoz’s dermatology development center, as well as manufacturing facilities in Wilson, North Carolina, and Hicksville and Melville, New York, which Aurobindo said are “highly complementary” to its existing production footprint.

When the deal was announced, investors in two other drug companies — Mylan and Teva — weren’t so happy. The reason? The US$ 900 million upfront payment reached by Novartis and Aurobindo was less than the 2017 annual revenue the portfolio sold, Wells Fargo analyst David Maris said.

Read more on Pharma Deals, Investments, M&As in September 2018